Research

Regulation-Induced Interest Rate Risk Exposure

Job Market Paper

Draft - Slides (60min) - Slides (25min)

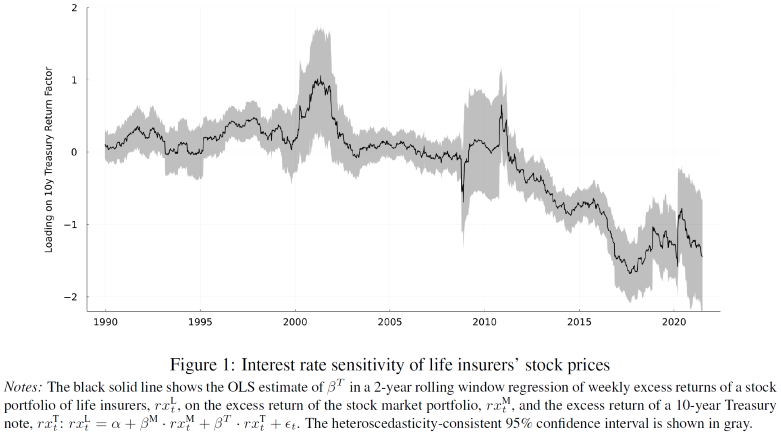

This paper documents the recent buildup of interest rate risk exposure in the U.S. life insurance sector and studies the role of regulation in shaping the hedging motives of these financial institutions. I quantify how much interest rate risk is borne by life insurers and find that they have become significantly exposed. By 2019, a one-percentage-point drop in the level of interest rates would have reduced their capital by $121 billion or 26%. In addition, lower interest rates decrease the profitability of issuing new policies – life insurers’ main source of revenue. To explain this risk-taking behavior, I provide a theoretical model and empirical evidence that show how statutory reserve regulation distorts the economic motive to hedge interest rate risk. My model offers recommendations for a better alignment of the existing regulation with macro-prudential principles.

Lending Frictions in the Corporate Bond Market: Evidence from Life Insurance Companies

Winner of the 2019 NYU Economics Third-Year Paper Award

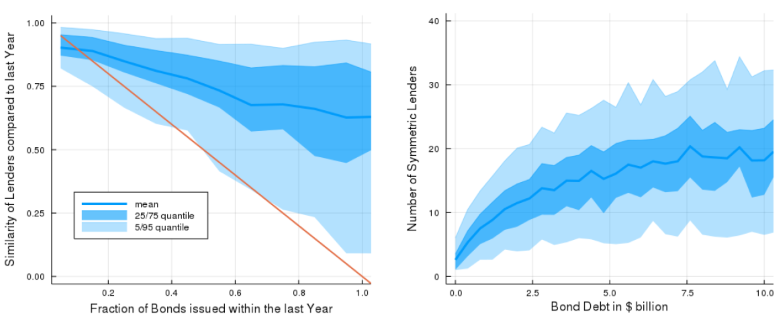

This paper documents that adverse financial shocks to life insurance companies propagate to firms in the real economy that borrow from them via the corporate bond market. First, I show that lending relationships are sticky beyond the refinancing of corporate bonds and that holdings are concentrated among few, large institutional investors. Then, I estimate the effect of a negative financial shock, measured by Koijen and Yogo (2015), on borrowings, interest rates, capital expenditures, and employment growth. I find negative effects that are about half of what has been measured in the literature on relationship banking. This is evidence that lending frictions also prevail in the open market for credit.

A Mortgage Genealogy of New York City

joint work with Daniel Stackman

work-in-progress

We create a family tree of mortgage agreements that tracks the issuance, change of lender, consolidation, repayment, and sale of every commercially operated property in New York City. We study the advent of covenants in these contracts and find more than 25% contain a downward nominal rigidity: the landlord must not decrease the rent.